ESG

- ESG Value

- CLASSYS is dedicated to delivering customer-oriented and innovative products and solutions, enabling beauty and happiness for all.

We firmly believe that ESG values will help shaping CLASSYS’ sustainable future, and We are committed to exploring and implementing ways for the company and society to coexist and thrive together.

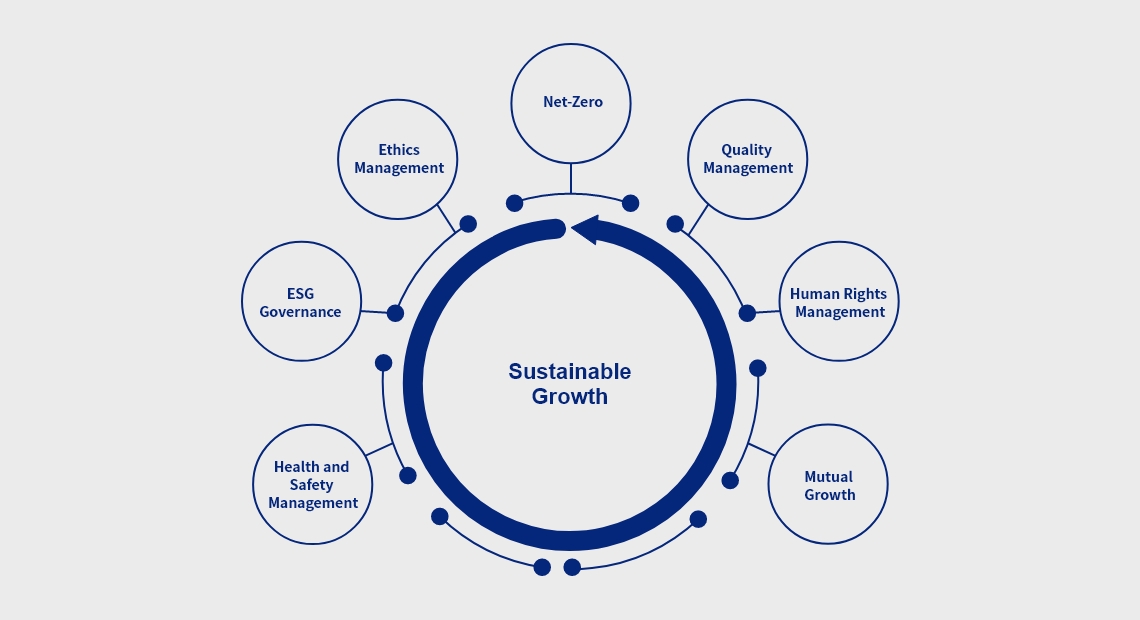

- ESG Strategy

- CLASSYS drives sustainable ESG value creation through stakeholder communication. Our transparent and professional governance, focused on ethical management, supports strategic initiatives like mutual growth, quality management, and carbon neutrality. Through cross-functional collaboration, we embody ESG values, keeping stakeholders informed of our sustainable progress and processes.

- ESG Ratings

- CLASSYS are committed to creating ESG value. We have received a B+ rating by the Korea Institute of Corporate Governance and Sustainability.

In particular, we have obtained an A rating in the corporate governance sector and have been recognized as an excellent corporate governance company.

- ESG Report

CASSYS 2022 Sustainability report - CLASSYS transparently reports on our actions to shape a sustainable future.

- ESG Policies

- We establish and implement policies for ESG value. We will communicate transparently with stakeholders about our progress and performance in

accordance with these policies.

- Implementing Net-Zero Governance

- CLASSYS has established net-zero governance and

is actively implementing projects to reduce our greenhouse gas emissions.

Establishing Board oversight

Dedicated EHS Team

Regular screening of environmental and safety laws and regulations

Energy and GHG inventory and monitoring

Company-wide education and campaigns

Zero environmental violations and fines in 2022

Additional KPIs for environmental indicators

Linking performance evaluation to compensation

Fostering a culture of embodying ESG

Continuous performance analysis and improvement

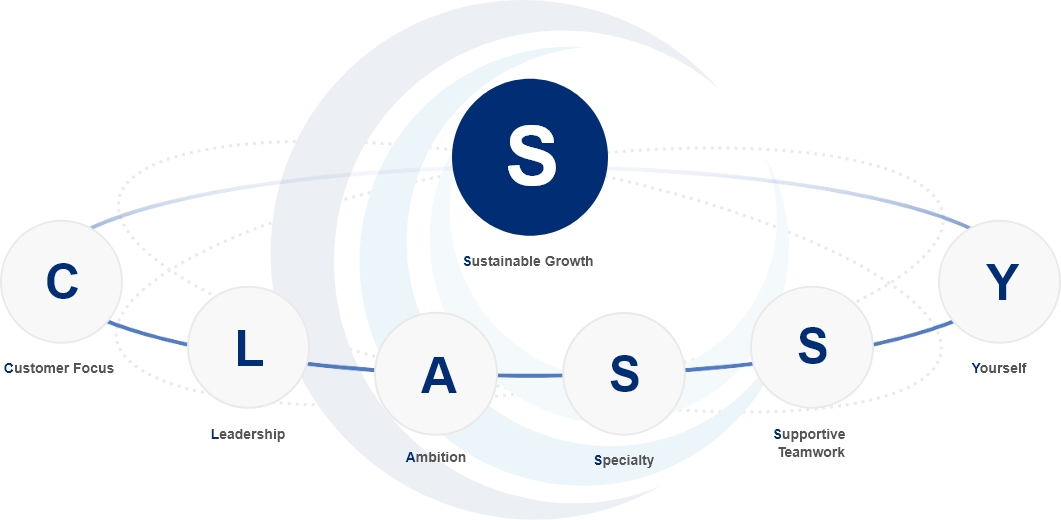

- Sustainable Growth and Mutual Growth

- CLASSYS is seeking talented people who can grow sustainably together, driven by customer-oriented values.

We provide diverse opportunities for shared growth.

- Growth for Our Sustainable Future

-

-

Respecting

diversity -

Onboarding

education -

Core Values

education -

Leadership training

programs -

Expert training

programs -

Fair

evaluations

-

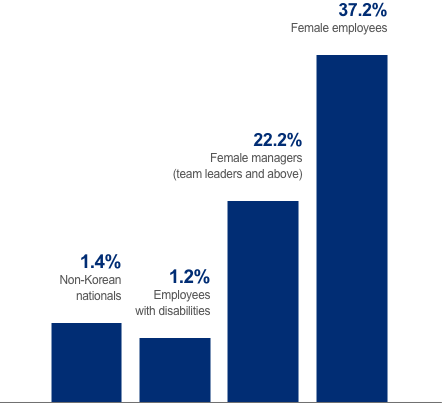

- Embracing Diversity and Creating a Welcoming Work Environment

- CLASSYS believes in providing equal opportunities during talent recruitment and has implemented various programs to foster

a harmonious work-life balance.

-

Support for personal

development(up to KRW 1,000,000 per year) -

Flexible start time(between 8 am to 10 am) -

Lunch and

dinner provided -

Support for

in-house club activities -

Support for

holiday bonuses -

in-house cafeteria

and rest facilities -

Support for health

examinations -

shortened work

hours during pregna -

parental leave -

Pre and

postnatal leave -

Support for

vacation allowances -

Flexible use of

paid time off

- Health, Safety, and Information Security

- CLASSYS employs secure and transparent management practices to

prevent disasters and incidents.

Operating a Dedicated EHS Team

Managing Safety and Health Regulations

Implementing Safety Accident Prevention Measures

Developing and Enforcing Accident Prevention Strategies

Company-wide Education and Campaigns

Performance Measurement and Continuous Improvement

Zero Industrial Accidents and Major Accidents in 2022

Operating a Dedicated IT Team

Managing Information Protection and Privacy Policies

Establishing Information Security Systems

Regularly Disposing of Personal Information

Preventive Management of Information Incidents

Company-wide Education and Campaigns

Zero Information Leakage Incidents in 2022

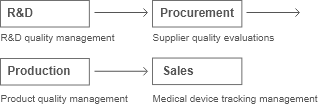

- Quality Management

- CLASSYS has implemented a robust quality management system and

processes to ensure the production of highly reliable and top-quality products.

Compliance with Good Manufacturing

Practice (GMP) certification from the

Ministry of Food and Drug Safety (MFDS)

for our production and quality management

of medical devices

Compliance with ISO 13485 for

a quality management system

in the medical device industry

Qualified product approvals from reputable

authorities such as the Ministry of

Food and Drug Safety Administration and

CE certification

In-House Quality Inspections

Continuous Quality Improvements

· Product Education

· Expert Training Programs

· Suggestion System

· TFT Program, etc.

Thorough Tracking Management

· UDI

· Serial

Results of the 8th Annual General Meeting

| Agenda | Result | As a percentage of total shares outstanding with voting rights | ||

| Attendance | Vote in favor | Votes against/abstentions | ||

| No.1. Approval of the 8th non-consolidated and consolidated financial statements (cash dividend of KRW 116 per share) | Approved | 67.5% | 67.2% | 0.3% |

| No.2. Amendment to the Articles of Incorporation | Approved | 67.5% | 67.4% | 0.1% |

| No.3. Approval of the remuneration cap of directors | Approved | 67.5% | 67.4% | 0.1% |

| No.4. Granting of stock options | Approved | 67.5% | 67.0% | 0.5% |

Dividend information for the last 5 years

| Category | Cash dividend per share (KRW) | Total cash dividends(KRW) | Consolidated cash dividend payout ratio (%) | Total dividend yield (%) |

| 2018 | 14 | 867,623,078 | 5.8% | 0.3% |

| 2019 | 46 | 2,960,761,480 | 8.9% | 0.3% |

| 2020 | 60 | 3,882,550,080 | 10.2% | 0.4% |

| 2021 | 66 | 4,271,313,024 | 9.8% | 0.3% |

| 2022 | 116 | 7,471,451,656 | 9.9% | 0.6% |

Appointments and Qualifications

Directors are appointed by the shareholder’s General Meeting upon the Board of Directors’ recommendations. In an appointment of directors, we ensure that Directors fulfill all legal requirements and qualifications specified in the Articles of Incorporation and comply with the appropriate procedures. In accordance with the provisions of Article 363 of the Commercial Law and Article 21 of the Articles of Incorporation, we provide written or electronic notice to shareholders of the time, place, and purpose of the general meeting at least two weeks in advance. When the purpose of the meeting involves director appointments, we also notify shareholders of the candidates’ names and biographies.

Career and Term

| Name | Career | Appointment | Term of office | |

| Period | Career | |||

|

Seung Han Baek CEO |

1991~1999 | B.A., Health Science, Yonsei University | 2022.03.31 | 2022.04.18 ~ 2024.03.29 |

| 2007~2009 | MBA, Helsinki School of Economics | |||

| 2017~2022 | CEO, BeckmanCoulter Korea | |||

| 2017~2022 | Director, Danaher Korea | |||

| 2019~2021 | Chairperson of In Vitro Diagnostic Products Committee of Korea Medical Devices Industry Association | |||

| 2022~Present | CEO, CLASSYS Inc. | |||

|

Lee, Jung Woo Non-executive director |

1996~2003 | BE in Industrial Engineering, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 2008~2010 | MBA, Wharton School, University of Pennsylvania, USA | |||

| 2015~Present | Partner, Bain Capital Private Equity (Asia), LLC (Hong Kong) | |||

| 2022~Present | Non-executive director, CLASSYS Inc. | |||

|

Kim, Dong Wook Non-executive director |

1995~1999 | BE in Electrical Engineering, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 2003~2005 | MBA, Columbia Business School | |||

| 2006~2020 | General manager, Citigroup Global Market Security | |||

| 2020~Present | Partner, Bain Capital Private Equity | |||

| 2022~Present | Non-executive director, CLASSYS Inc. | |||

|

Kim, Hyunseung Non-executive director |

1998~2006 | BE in Industrial Engineering, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 2018~Present | Senior executive director, Bain Capital Private Equity | |||

| 2022~Present | Non-executive director, CLASSYS Inc. | |||

|

Park, Wan Jin Non-executive director |

2008~2014 | Stanford University, BA of Economics, MS of Management Science & Engineering |

2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 2016~Present | Executive director, Bain Capital Private Equity | |||

| 2022~Present | Non-executive director, CLASSYS Inc. | |||

|

Park, Jun Hong Outside director |

1988 | BA in Management, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 1989 | MA, Business School, Seoul National University | |||

| 1991 | University of Michigan, Ann Arbor MBA | |||

| 2017~2020 | Managing director/Vice president, Johnson & Johnson, Vietnam | |||

| 2021~Present | Outside director, Ildong Holdings Co., Ltd | |||

| 2022~Present | Outside director and Audit Committee member,

CLASSYS Inc. |

|||

| Hyuk Jin Kwon Outside director |

1989 | BA in Economics, College of Social Science, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 1991 | MA in Financial Management, Business School, Seoul National University | |||

| 2017 | Ph.D in Finance & Accounting, Business School, Dongguk University | |||

| 2015~2019 | CEO of consulting unit, NamuCorp Co., Ltd | |||

| 2020~2021 | Director/Vice president, Jungjin Accounting Corp. | |||

| 2021~Present | Standing auditor, Kolon Life Science | |||

| Present | Adjunct Prof., Dongguk Univ. (Dept. of Accounting) | |||

| 2022~Present | Outside director and Chairperson of Audit Committee, CLASSYS Inc. | |||

|

Kim, Dong Ju Outside director |

1997 | MA in Psychology, Yonsei University | 2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 2002 | MBA, Wharton School, University of Pennsylvania, USA | |||

| 2018~2021 | Country general manager, Sephora Korea | |||

| 2021~Present | Founder and CEO, LAVOIR | |||

| 2022~Present | Outside director and Audit Committee member, CLASSYS Inc. |

|||

Committees

| Nomination Committee | |

| Purpose | The committee evaluates the overall competence of director nominees, taking into account their independence, transparency, expertise, and other factors, and makes recommendations accordingly. |

| Delegation of authority | 1. Establish criteria for selecting Independent Director candidates 2. Recommend Independent Director candidates 3. Other matters delegated by the Board |

| Members | Kim Dong Ju(Chair), Seung Han Baek, Kim Hyun seung |

| Pay Committee | |

| Purpose | The committee deliberates on matters such as the resolution of director compensation and the compensation system. |

| Delegation of authority | 1. Propose a remuneration cap for directors at the AGM 2. Deliberate internal director’s individual remuneration 3. Other matters delegated by the Board |

| Members | Hyuk Jin Kwon(Chair), Kim, Dong Wook, Park, Wan Jin |

Activities

| Date | Agenda | Result | Outside directors’ Approval/ Attendance/ Capacity |

| 2022.02.15 | Reporting 1) ICFR operation status by CEO | Reported | 3/3/3 |

| Reporting 2) Completion of investment in financial assets | Reported | 3/3/3 | |

| Reporting 3) Completion of investment in property, plant, and equipment | Reported | 3/3/3 | |

| Reporting 4) Status of main contracts | Reported | 3/3/3 | |

| No.1. Approval of the 7th financial statements | Approved | 3/3/3 | |

| No.2. Approval of the 7th business report | Approved | 3/3/3 | |

| No.3. Convening the ordinary general meeting of shareholders | Approved | 3/3/3 | |

| No.4. Approval of the estimated amount of incentives | Approved | 3/3/3 | |

| 2022.02.15 | No.1. Change of the location of main office | Approved | 3/3/3 |

| 2022.03.15 | No.1. Recommendation of director and audit committee member candidates | Approved | 2/2/3 |

| No.2. Amendment to the Articles of Incorporation and two others | Approved | 2/2/3 | |

| No.3. Addition of an agenda to the ordinary general meeting of shareholders | Approved | 2/2/3 | |

| 2022.03.15 | No.1. Establishment of branch office | Approved | 2/2/3 |

| 2022.03.16 | No.1. Recommendation of director and audit committee member candidates | Approved | 2/2/3 |

| No.2. Changes in schedule and agenda of the ordinary general meeting of shareholders | Approved | 2/2/3 | |

| 2022.03.22 | Reporting 1) Evaluation of ICFR and one more reporting | Reported | 3/3/3 |

| Reporting 2) Pre- and post-audit adjustments of the financial statements | Reported | 3/3/3 | |

| 2022.03.22 | No.1. Payment of severance pay | Approved | 3/3/3 |

| 2022.04.14 | No.1. Appointment of CEO | Approved | 3/3/3 |

| 2022.04.14 | No.1. Approval of compensation of registered executives | Approved | 3/3/3 |

| No.2. Evaluation of the appropriateness of ICFR manager and a team in charge of ICFR | Approved | 3/3/3 | |

| No.3. Amendment to the bylaws on the board of directors | Approved | 3/3/3 | |

| 2022.05.12 | No.1. Approval of the first-quarter financial results | Approved | 3/3/3 |

| 2022.08.10 | Reporting 1) Evaluation of the appropriateness of ICFR | Reported | 3/3/3 |

| Reporting 2) First half financial results | Reported | 3/3/3 | |

| No.1. Amendment to the bylaws on the board of directors | Approved | 3/3/3 | |

| No.2. Approval of the result of establishing the support policy | Approved | 3/3/3 | |

| 2022.09.15 | No.1. Approval of treasury stock purchase trust agreement | Approved | 3/3/3 |

| 2022.09.15 | No.1. Approval of asset management plan | Rejected | 0/3/3 |

| Reporting 1) Costs related to the interior decoration of new office | Reported | 3/3/3 | |

| 2022.10.28 | No.1. Closure of branch office | Approved | 3/3/3 |

| 2022.11.10 | Reporting 1) Third-quarter financial results | Reported | 3/3/3 |

| Reporting 2) Consulting contract | Reported | 3/3/3 | |

| No.1. Approval of fund operation plan | Approved | 3/3/3 | |

| 2022.12.21 | Reporting 1) Succession plan | Reported | 3/3/3 |

| No.1. Amendment to the bylaws on the organization and roles | Approved | 3/3/3 | |

| 2022.12.21 | No.1. Addition of lease business and report of the closed place of business | Approved | 3/3/3 |

Appointment, Independence, and Duties

Our Audit Committee operates under the Audit Committee Charter in accordance with relevant laws, regulations, and the Articles of Incorporation. The Committee is composed of independent directors appointed by the shareholders’ General Meeting upon the Board of Directors’ recommendations, and the Committee includes accounting and financial experts. There are no relationships between the Committee members and the Company or its major shareholders that could compromise the Committee’s independence. Moreover, the Committee meets all legal requirements, including having chaired by an independent director.

The Audit Committee carries out its responsibilities as follows: It reviews accounting documents, such as financial statements, and the audit procedures and results conducted by external auditors. When necessary, the Committee requests additional reviews of books and related documents and evaluates the findings. Furthermore, the Committee receives reports from the internal accounting officer and assesses the functioning of the internal control over financial reporting system, ensuring the preparation and disclosure of reliable financial information. Additionally, the Audit Committee participates in important meetings, including the Board of Directors gatherings, to conduct audits of the business. If required, the Committee receives reports on management and business from directors and reviews important business reports using appropriate methods, including requesting further reviews and supplementary materials.

Career and Term

| Name | Career | Appointment | Term of office | |

| Period | Career | |||

|

Park, Jun Hong Outside director and Audit Committee member |

1988 | BA in Management, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 1989 | MA, Business School, Seoul National University | |||

| 1991 | University of Michigan, Ann Arbor MBA | |||

| 2017~2020 | Managing director/Vice president, Johnson & Johnson, Vietnam | |||

| 2021~Present | Outside director, Ildong Holdings Co., Ltd | |||

| 2022~Present | Outside director and Audit Committee member,

CLASSYS Inc. |

|||

| Hyuk Jin Kwon Outside director and Chairperson of Audit Committee |

1989 | BA in Economics, College of Social Science, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 1991 | MA in Financial Management, Business School, Seoul National University | |||

| 2017 | Ph.D in Finance & Accounting, Business School, Dongguk University | |||

| 2015~2019 | CEO of consulting unit, NamuCorp Co., Ltd | |||

| 2020~2021 | Director/Vice president, Jungjin Accounting Corp. | |||

| 2021~Present | Standing auditor, Kolon Life Science | |||

| Present | Adjunct Prof., Dongguk Univ. (Dept. of Accounting) | |||

| 2022~Present | Outside director and Chairperson of Audit Committee, CLASSYS Inc. | |||

|

Kim, Dong Ju Outside director and Audit Committee member |

1997 | MA in Psychology, Yonsei University | 2022.03.31 | 2022.03.31 ~ 2024.03.29 |

| 2002 | MBA, Wharton School, University of Pennsylvania, USA | |||

| 2018~2021 | Country general manager, Sephora Korea | |||

| 2021~Present | Founder and CEO, LAVOIR | |||

| 2022~Present | Outside director and Audit Committee member,

CLASSYS Inc. |

|||

Activities

|

Date |

Agenda |

Result |

Approval/ Attendance/ Capacity |

|

2022.02.15 |

Reporting 1) Report of the 7th business report the 7th Financial Statements |

Reported |

3/3/3 |

| Reporting 2) ICFR operation status by CEO |

Reported |

3/3/3 |

|

| Reporting 3) Communication by the external auditor |

Reported |

3/3/3 |

|

| Reporting 4) Internal audit result |

Reported |

3/3/3 |

|

| Reporting 5) Status of IWS operation |

Reported |

3/3/3 |

|

| Reporting 6) Status of disclosure execution |

Reported |

3/3/3 |

|

| Reporting 7) Conclusion of external audit contract |

Reported |

3/3/3 |

|

| Reporting 8) Creation of new accounts |

Reported |

3/3/3 |

|

| No.1. Evaluation of ICFR operation status |

Approved |

3/3/3 |

|

| No.2. Approval of the Audit Report and Auditor’s Opinion Letter |

Approved |

3/3/3 |

|

|

2022.03.22 |

No.1. Deliberation on agenda at the ordinary general meeting of shareholders |

Approved |

3/3/3 |

| No.2. Evaluation of audit activities |

Approved |

3/3/3 |

|

|

2022.04.14 |

Reporting 1) Completion of the project for ICFR sophistication |

Reported |

3/3/3 |

| Reporting 2) Evaluation of the appropriateness of ICFR manager and a team in charge of ICFR |

Reported |

3/3/3 |

|

| No.1. Election of the chairperson of the audit committee and designation of the order of acting duties in case the chairperson is absent |

Approved |

3/3/3 |

|

| No.2. Succession of the audit committee support organization |

Approved |

3/3/3 |

|

| No.3. Approval of the plan for audit committee operation |

Approved |

3/3/3 |

|

|

2022.05.11 |

Reporting 1) Communication by the external auditor |

Reported |

3/3/3 |

| Reporting 2) The first-quarter financial results |

Reported |

3/3/3 |

|

| Reporting 3) ICFR plan and progress |

Reported |

3/3/3 |

|

| Reporting 4) Status of IWS operation |

Reported |

3/3/3 |

|

| Reporting 5) Status of disclosure execution |

Reported |

3/3/3 |

|

| No.1. 1st plan to investigate the ICFR operation status |

Approved |

3/3/3 |

|

| No.2. Internal audit plan |

Approved |

3/3/3 |

|

|

2022.08.10 |

Reporting 1) First half financial results |

Reported |

3/3/3 |

| Reporting 2) Interim report of ICFR |

Reported |

3/3/3 |

|

| Reporting 3) Result of internal audit |

Reported |

3/3/3 |

|

| Reporting 4) Status of IWS operation |

Reported |

3/3/3 |

|

| Reporting 5) Status of disclosure execution |

Reported |

3/3/3 |

|

|

2022.11.23 |

Reporting 1) Third-quarter financial results |

Reported |

3/3/3 |

| Reporting 2) Interim report of ICFR |

Reported |

3/3/3 |

|

| Reporting 3) Result of internal audit |

Reported |

3/3/3 |

|

| Reporting 4) Status of IWS operation |

Reported |

3/3/3 |

|

| Reporting 5) Status of disclosure execution |

Reported |

3/3/3 |

Policies to ensure independence and expertise when appointing external auditor

For the appointment of an external auditor, the Audit Committee reviews proposals of firms and assesses candidates and approves the agenda item to appoint an external in accordance with the Act on External Audit of Stock Companies and a regulation regarding the appointment of an external auditor. Based on the approval of the Audit Committee, an external auditing contract is signed with external auditors. The Company consults with external auditors to determine the audit time, capacity, fees, and plan, ensuring the auditor’s independence. Also, the Audit Committee evaluates after the conclusion of the external audit whether the external auditor has fulfilled its duties and whether the content and frequency of communications were appropriate.

Appointment status

In accordance with Article 11-2 of the Act on External Audit of Stock Companies, we were requested to use a designated external auditor in 2022, after voluntarily appointing an external auditor for six consecutive years. In October 2021, the Securities & Futures Commission designated Nexia Samduk as an external auditor for three consecutive years from FY2022 through FY2024.

|

Name |

Appointment |

Term |

Remark |

|

Nexia Samduk |

2021.12.27 |

FY2022 ~ FY2024 |

Designated external auditor |

Provision of non-audit services by an external auditor

No non-audit services have been provided by Nexia Samduk to CLASSYS. The Audit Committee conducts preliminary reviews on the non-audit services from external auditors and approves only if they do not compromise independence and audit quality.